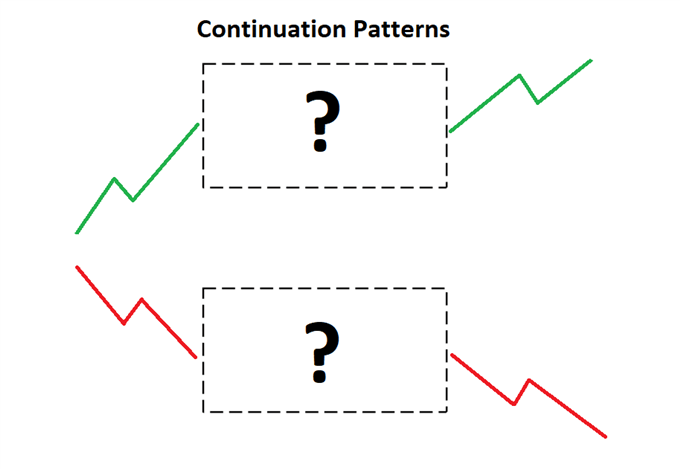

Continuation patterns can present favorable entry levels to trade in the direction of the prevailing trend. Keep reading to find out more about trading with continuation patterns, and the best bearish and bullish formations to include in your technical analysis.

WHAT ARE CONTINUATION PATTERNS?

Continuation Patterns are recognizable chart patterns that signify a period of temporary consolidation before continuing in the direction of the original trend. Consolidation appears in the form of sideways price movement. The pattern completes itself upon a strong breakout of the consolidation zone, resulting in the continuation of the preceding trend. Continuation patterns usually play out over the short to intermediate term.

BULLISH CONTINUATION PATTERNS

Bullish continuation patterns appear midway through an uptrend and are easily identifiable. The main bullish continuation patterns are introduced below.

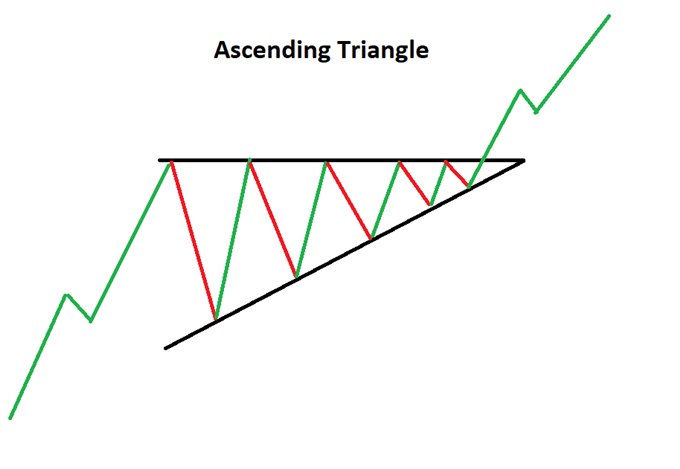

1. Ascending triangle

An ascending triangle pattern is a consolidation pattern that occurs mid-trend and usually signals a continuation of the existing trend. The pattern is formed by drawing two converging trendlines (flat upper trendline and rising lower trendline), as price temporarily moves in a sideways direction. Traders look for a subsequent breakout, in the direction of the preceding trend, as a cue to enter a trade.

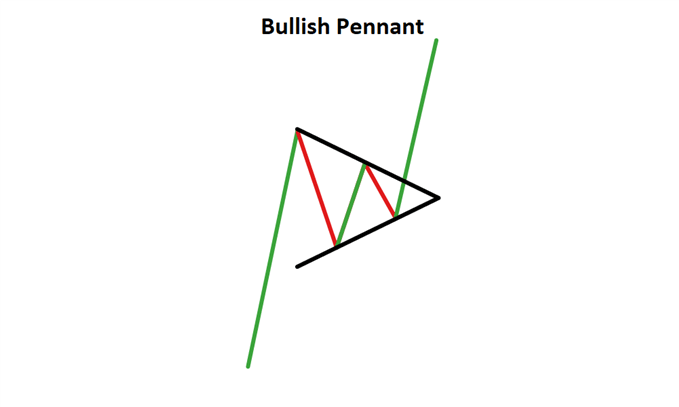

2. Bullish Pennant

A bullish Pennant pattern is a continuation chart pattern that appears after a security experiences a large, sudden upward movement. It develops during a period of brief consolidation, before price continues to move in the direction of the trend with the same initial momentum.

The triangular pattern is called a Pennant, which is made up of numerous forex candlesticks and is not to be confused with the larger, symmetrical triangle pattern.

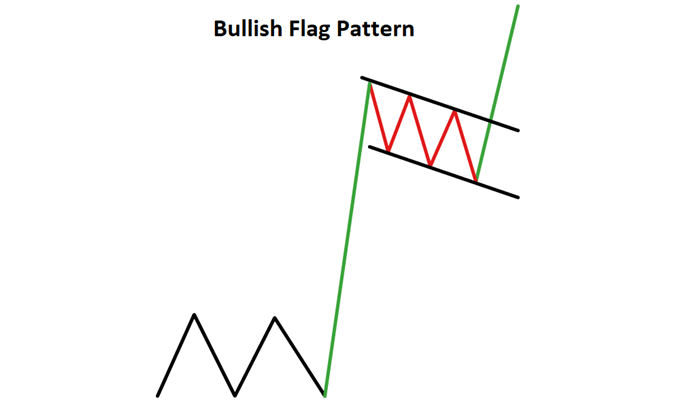

3. Bullish Flag

The bullish flag pattern is a great pattern for traders to master. Explosive moves are often associated with the bull flag as it provides a temporary respite to a sharp initial move. The bull flag and pennant pattern appear under the same conditions (sharp and sudden move in price) however the bull flag can offer more attractive entry levels.

The bull flagis characterized by a downward sloping channel denoted by two parallel trendlines against the preceding trend.

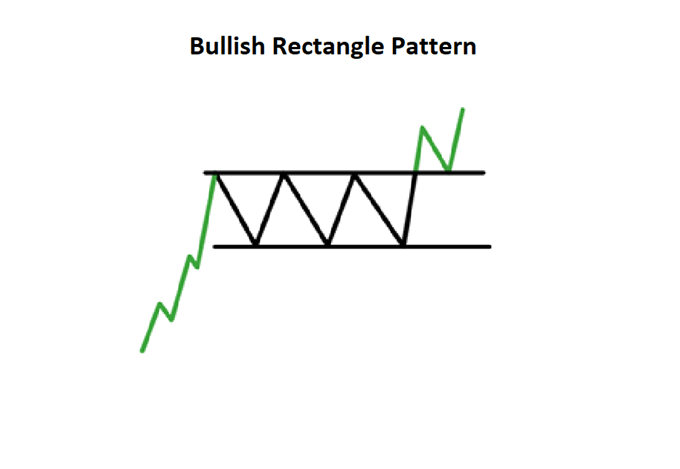

4. Bullish Rectangle pattern

The rectangle pattern characterizes a pause in trend whereby price moves sideways between a parallel support and resistance zone. The pattern indicates a consolidation in price before continuing in the original direction of the existing trend. The added benefit of this pattern is that traders have the opportunity to trade within the range or trade the eventual breakout, or both.

BEARISH CONTINUATION CANDLESTICK PATTERNS

Bearish continuation patterns appear midway through a downtrend and are easily identifiable. The bearish versions of the similar patterns introduced above have the same impact but in the opposite direction. The main bearish continuation patterns are introduced below.

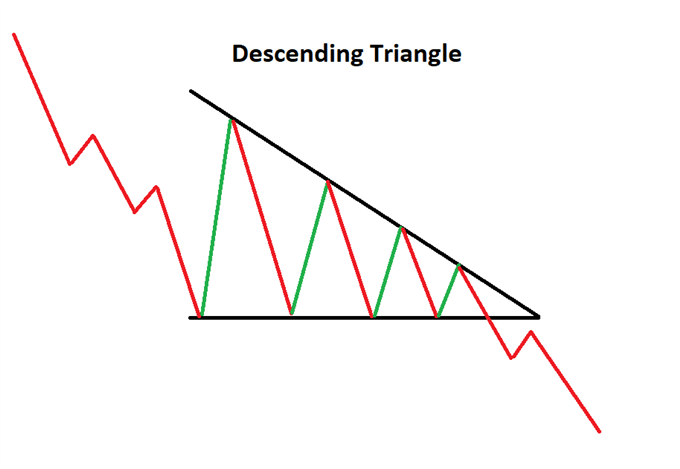

1. Descending Triangle

The descending triangle pattern is a consolidation pattern that occurs mid-trend and usually signals a continuation of the existing downtrend. The pattern is formed by drawing two converging trendlines (descending upper trendline and flat lower trendline), as price temporarily moves in a sideways direction. Traders look for a subsequent breakout, in the direction of the preceding trend, as a milestone to enter a trade.

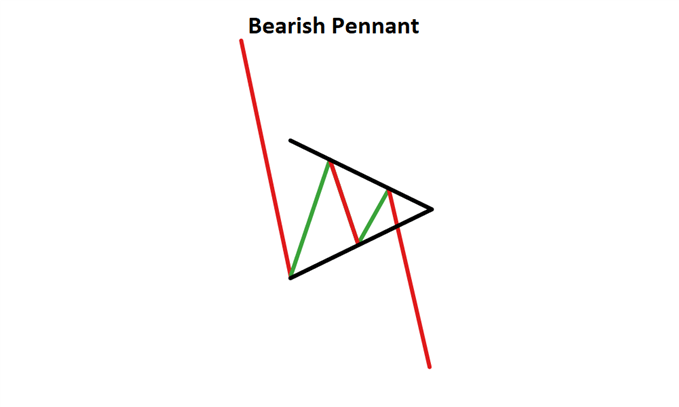

2. Bearish Pennant

The bearish pennant is a continuation chart pattern that appears after a security experiences a large, sudden drop. It develops during a period of brief consolidation, before price continues lower, in the direction of the prevailing trend.

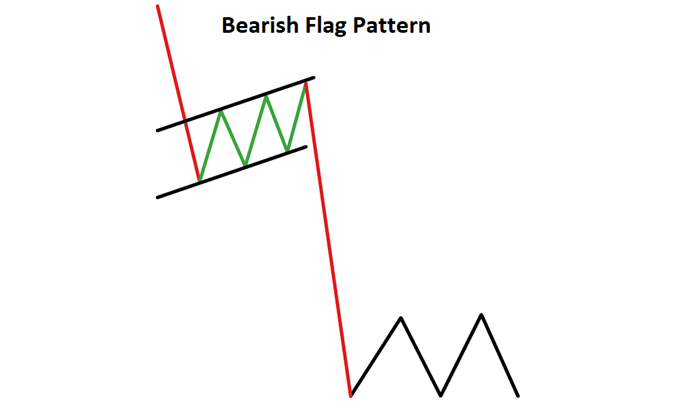

3. Bearish flag

Just like the bullish flag, the bearish flag is often associated with explosive moves before and after the appearance of the flag.

The bear flagis characterized by an upward sloping channel denoted by two parallel trendlines slanting against the preceding trend.The flag is not to be confused with the rectangle pattern. The flag is completed in a much shorter time period (one to three weeks) compared to the rectangle pattern and has a noticeable gradient.

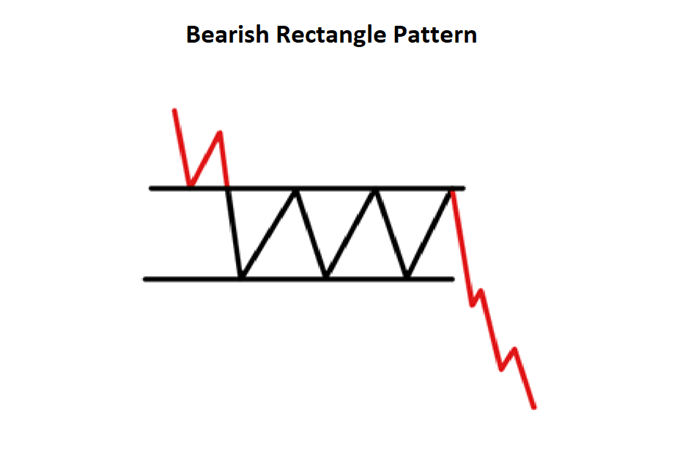

4.Bearish Rectangle

The bearish rectangle pattern characterizes a pause in trend whereby price moves sideways between a parallel support and resistance zone. The pattern indicates a consolidation in price before continuing in the original direction of the existing trend. Traders have the opportunity to trade within the range or trade the eventual breakout, or both.

TRADING CONTINUATION PATTERNS

Continuation patterns tend to be goodindicators of future price movement,provided traders adhere to the following tips:

- Identify the direction of the trend before price starts to consolidate.

- Make use of trendlines to identify which continuation pattern may be developing.

- After successfully identifying the continuation pattern, set appropriate stops and limits while adhering to a positive risk to reward ratio.

- Traders can wait for a strong breakout in the direction of the trend before entering. Furthermore, traders should consider placing a tight stop to protect from a false breakout and trail this stop if the market moves favorably. Consider this and other risk management strategies to employ.

No comments:

Post a Comment