Trend lines

Trend lines are amazing tools to visualize the trend and spot potential reversal points. Traders, however, usually don’t draw them properly. They try to make the market fit the line, instead of making the line fit the market. This misuse of trend lines often results in major losses for traders.

It’s easier than you think.

This article will help you understand what trends are and how to recognize them. We will then explain how to properly draw trend lines. Finally, we will see how to use trend lines, which will definitely help you become a more profitable trader.

1. What Is A Trend And How To Recognise It

While building a comprehensive trading plan, it’s important to know about the different ways to analyze the markets. Fundamental Analysis, Technical Analysis, and Sentiment Analysis are the 3 main types of market analyses.

So what’s it all mean?

While Fundamental Analysis will help you to decide in which assets to invest, technical analysis will help you to determine when. As we will see, the concept of the trend is the cornerstone of Technical Analysis. Trend lines are therefore essential tools to correctly analyze the markets and invest in a more solid way.

Fundamental Analysis vs Technical Analysis

Fundamental Analysis is about understanding the economic forces that impact the supply/demand relationship of an asset that will cause prices to move. Technical Analysis, however, studies the effects – not the causes.

The technical approach is based on 3 premises:

Market action discounts everything, history repeats itself, and prices move in trends.

Technical Analysis will then look at past market movements to predict future prices trends.

The concept of a trend is then essential to technical analysts. They will often read charts with the sole purpose of identifying trends. They will especially focus on recognizing a trend’s early stages, so then they can trade trends while they develop. This method is called trend trading.

Trends according to the Dow’s Theory

Even though Charles Dow never published a book while he was alive, he set down several ideas about the stock market, which were published in The Wall Street Journal. Nelson, S. A. then compiled these editorials in a book called The ABC of Stock Speculation. It’s only then that the term “Dow’s Theory” was invented. It refers to several basic tenets that technical analysts use to study the markets. Let’s focus on 2 of these basic tenets here.

Market Trends

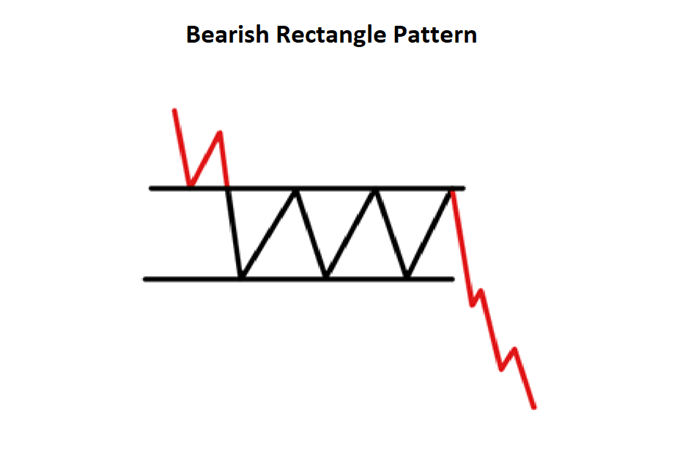

Most traders believe that the markets only evolve upward or downward. However, markets can also trade sideways. This lateral consolidation happens when market participants are undecided, which occurs about 1/3 of the time. Dow defines an uptrend as situations where prices form higher highs and higher lows. Conversely, a downward trend is defined as a pattern of falling peaks and throughs.

Each trend is also supposed to have 3 different parts: a primary trend, a secondary trend, and a minor trend. The secondary trend is a corrective movement within the primary one and lasts from 3 weeks to 3 months. The minor trend is a fluctuation within the secondary trend and usually, lasts less than 3 weeks.

The Phases Of Trends

Dow focused his work on major trends and explained that they often take place in 3 phases. First, there is the accumulation phase, followed by a public participation phase, followed lastly by a distribution phase.

The 1st phase begins with experienced traders. They will notice a stock, recognize that it’s hit bottom, and buy while it’s still good value.

The 2nd phase happens when other traders, who are perhaps less experienced, enter the markets. This is when most technical trend following analysts enter the markets. Usually, market prices will accelerate and the news will be more positive about a given financial asset.

The last stage takes place when the news is extremely positive and bullish on this asset. The same traders that went bullish on the asset while no one wanted to buy it now start to sell it before anyone else.

2. What Are Trend Lines And How To Draw Them

Trend lines will help you to spot areas on a chart where the supply/demand for a given asset has increased.

The above chart shows first an uptrend line on the EUR/USD currency pair. The uptrend line has a positive slope connecting low points, with multiple connected points ascending upwards. Uptrend lines play the support role – as long as prices are above them, the bullish trend is intact.

To sum up:

A trend line is a straight line that connects several points on a chart, which can be used to both establish trends, and to forecast the future direction of a given asset, with trend lines acting as a support/resistance lines. The trend lines show zones where the forces of supply and demand meet and push prices to move.

A support level is a level where the demand for an asset is stronger than the selling pressure, preventing prices from falling further.Conversely, a resistance level is a threshold at which selling pressure is greater than buying pressure.

How To Correctly Draw Trend Lines

If there is an uptrend, the 1st thing to do is to draw an ascending support trend line. Conversely, if there is a downtrend, you should draw a descending resistance line. If you draw an ascending resistance trend line with an upward trend, you won’t get any relevant information. You can only see a potential change in the current trend with an ascending support line. This line will indicate that the previous bullish movement is no longer valid.

Here are other important criteria to take into consideration when using trend lines.

- Time frames – Higher time frames will always produce the most reliable trend lines.

- Validation – In geometry, you need 2 points to draw a line. In Technical Analysis, you need 3 points to draw a trend line. The more points touching the line, the more solid and valid the line will be.

- The spacing of points – The points used to draw the trend line shouldn’t be too close or too far away from each other.

- Overlap – Highs and lows from candles will sometimes overlap with the trend line, but it’s important to have the bodies of candles touching the trend line.

- Psychological Reaction on the Line – The points of contact should always trigger a price reaction. A psychological reaction from market participants should then always happen in contact with the line.

- Angles – The steeper the trend line, the weaker its validity will be. A very steep trend line usually shows a sharp price advance/decline, which will not offer meaningful support/resistance levels.

- 3.Using Trend Lines To Make Profitable Trades

On the below chart, you can see that the price had followed the ascending support trend line for a number of years. Every time prices touched the trend line, you could have reliably opened a long position and traded with the trend. Trend lines are also useful tools to detect potential reversal points.

After an upward acceleration, prices eventually lost momentum: the highs and lows became lower and lower. Once prices broke the trend line with a long red candle (bearish marubozu), they retested the former support. This level then became a new resistance level, as highlighted in the rectangle of the same chart. This is called a pullback. This retest gave you a perfect selling trading opportunity to make profits.

As you now understand, trend lines are useful trading tools to implement in your investment strategy, as they can help you to make more profitable trades. When prices touch a trend line, it gives you an opportunity to enter the markets with the main trend. When price breaks a trend line it is usually with higher trading volume. Potential buying or selling trading opportunities will appear once a trend line is retested after being broken.